What is Impermanent Loss?

If you’ve been trading decentralized exchanges for a while you might have probably heard about impermanent loss.

Popular DeFi protocols like Pancakeswap, Spookyswap, Uniswap, and Sushiswap enable anyone to become a market maker and earn trading fees.

So what is Impermanent Loss?

This is the unrealized loss that occurs when your share of the liquidity provider position becomes uneven compared to its original position.

It is also known for providing liquidity to dual-asset pools in DeFi protocols. It is the difference in value between depositing two cryptocurrency assets within an Automated Market Maker-based liquidity pool or simply holding them in a cryptocurrency wallet.

Impermanent loss only happens to people that provide liquidity to a liquidity pool.

Let’s take BNB and BUSD for a better explanation.

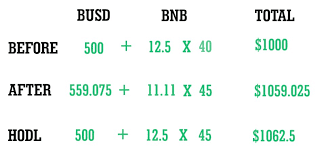

Mubaraq deposits 1 BNB and 100 BUSD in a liquidity pool. In this particular automated market maker (AMM), the deposited token pair needs to be of equivalent value. This means that the price of BNB is 100 BUSD at the time of deposit. This also means that the dollar value of Mubaraq’s deposit is 200 USD at the time of deposit.

In addition, there’s a total of 10 BNB and 1,000 BUSD in the pool — funded by other LPs just like Mubaraq. So, Mubaraq has a 10% share of the pool, and the total liquidity is 10,000.

Let’s say that the price of BNB increases to 400 BUSD. While this is happening, arbitrage traders will add BUSD to the pool and remove BNB from it until the ratio reflects the current price. Remember, AMMs don’t have order books. What determines the price of the assets in the pool is the ratio between them in the pool. While liquidity remains constant in the pool (10,000), the ratio of the assets in it changes.

If BNB is now 400 BUSD, the ratio between how much BNB and how much BUSD is in the pool has changed. There are now 5 BNB and 2,000 BUSD in the pool, thanks to the work of arbitrage traders.

So, Mubaraq decides to withdraw his funds. As we know from earlier, he’s entitled to a 10% share of the pool. As a result, he can withdraw 0.5 BNB and 200 BUSD, totaling 400 USD. He made some nice profits since his deposit of tokens worth 200 USD, right? But wait, what would have happened if he simply held his 1 BNB and 100 BUSD? The combined dollar value of these holdings would be 500 USD now.

We can see that Mubaraq would have been better off by HODLing rather than depositing into the liquidity pool. This is what we call impermanent loss. In this case, Mubaraq’s loss wasn’t that substantial as the initial deposit was a relatively small amount.

Keep in mind, however, that impermanent loss can lead to big losses (including a significant portion of the initial deposit).

With that said, Mubaraq’s example completely disregards the trading fees he would have earned for providing liquidity. In many cases, the fees earned would negate the losses and make providing liquidity profitable nevertheless. Even so, it’s crucial to understand impermanent loss before providing liquidity to a DeFi protocol.

There are some calculators used in forecasting and calculating impermanent loss before and after providing liquidity to a pool, you can do more research to know how it works.

Remember, until you sell off your liquidity you cannot run at a loss.

As the name implies impermanent means ‘intended to last, continue, or serve for a limited time.